Timely Blog

Your partner in time

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Party time! Our epic G2 badge haul thanks to you, our amazing time trackers

Explore why Timely is winning! Celebrate our spring badges on G2 and discover why users love us.

What’s new: Guard productivity and profits with Locked Time

Explore Timely's latest feature, Locked time, designed to safeguard your team's timesheets effortlessly. Discover how Locked time enhances payroll, billing, and profitability analysis, and how it harmonizes seamlessly with Time Entry States for streamlined time tracking.

Time Entry States: A Manager's Dream

Revolutionize time tracking with Time Entry States: Customize statuses, enhance oversight, and streamline processes. Accessible under Workspace Settings > States for a smoother, more efficient experience

Timely and Asana: a dream for project management.

Elevate project management with Timely and Asana Integration! Effortless time tracking, accurate estimations, and seamless workflow optimization.

Integrated time tracking

Timely's integrations are more than just connectors; they're catalysts for change in the way you manage projects. Explore the possibilities, embrace the efficiency, and let Timely be your best ally in the pursuit of a streamlined, productive workflow.

What’s new in Timely: Quarterly update winter 2024

Exciting Timely Product Update: Winter 2024! 🚀 Sleek Memory for Mac overhaul, Time Entry States, smarter AI tags, and seamless monday.com integration. Streamline time tracking, improve efficiency, and enhance project management. Explore now!

Figuring out Team Member Capacity

Maximize project success with Timely's toolkit for resource allocation in project management. From the centralized people dashboard to setting utilization rates and KPIs, effortlessly optimize your team's capacity and hit project targets

Project Details in Timely

Categorize time spent seamlessly, gaining insights into resource allocation and project progress. Stay on budget, keep stakeholders informed, and save time and money with Timely's intuitive features.

Privacy in time tracking

At Timely, privacy is paramount, and our commitment is unwavering. In this video, discover why trust is the cornerstone of our business. Timely is designed to empower teams to excel in their work. Secure Data Handling. Your Data, Your Control. Perfect for Consultants

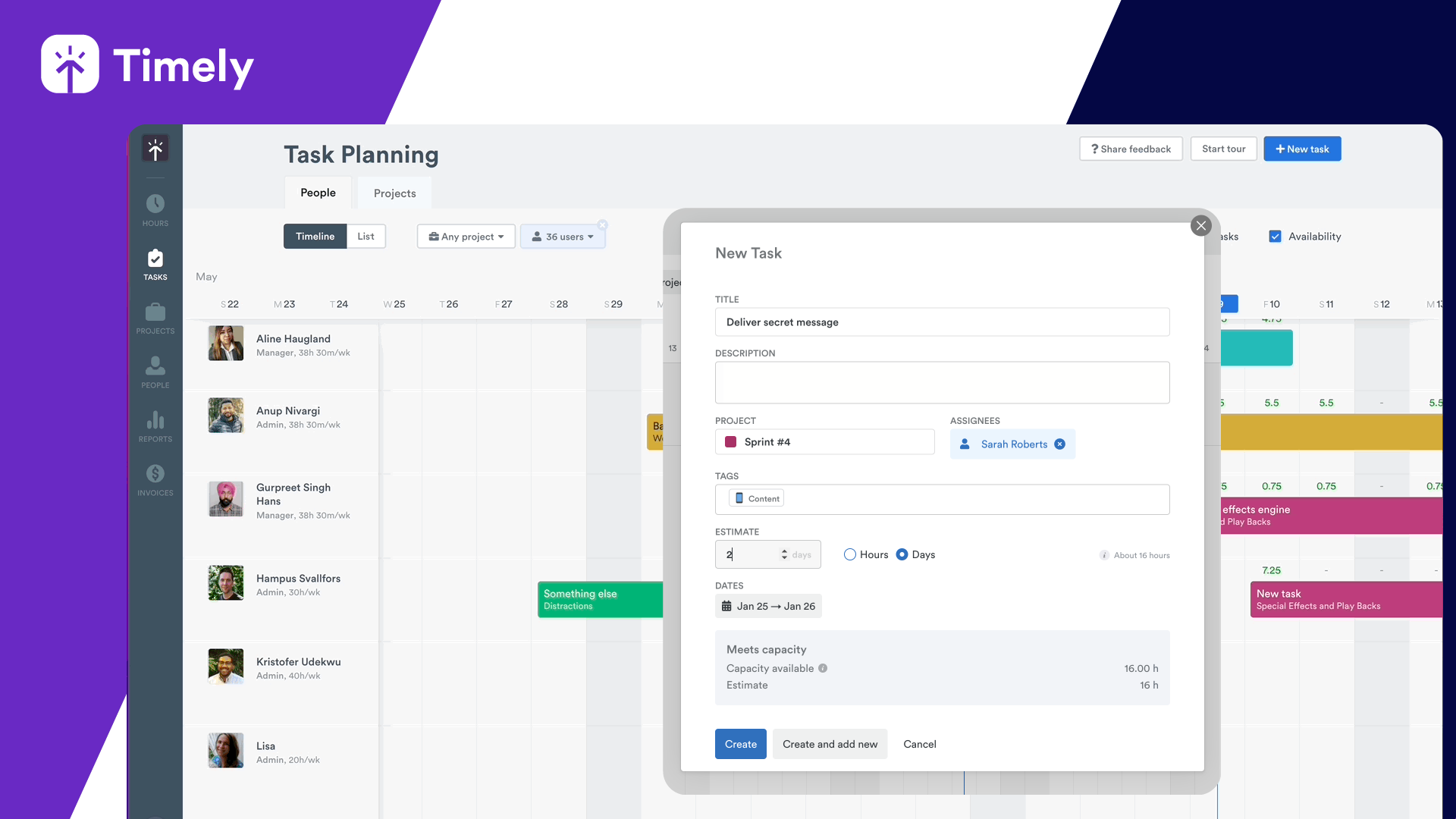

Streamline Task Management with Timely

Elevate productivity with Timely's automated task management. Streamline planning, tracking, and reporting effortlessly for efficient collaboration. Say goodbye to manual time tracking.

Making Utilization Rates Easy

Hourly businesses, track utilization rates with Timely for cost coverage, resource optimization, and smart decisions. Efficient billing made easy.

Reporting and Budgeting with Timely

Abbie dives into how Timely's budgeting feature keeps you in the loop without those budget surprises. Dashboard Magic. No More Guesswork. Stay in the Know. Real Stories, Real Wins.

4 Ways Timely is Best

Why Consultants love Timely?

Accurate Time Tracking, Easy-to-Use Interface, Timely's Commitment to Privacy, AI-powered Time Tracking

Streamline your time management with Timely's winning combination of accuracy, user-friendliness, privacy, and AI innovation

Effortlessly Track Your Time and Boost Your Efficiency with Timely!

Accurately billing

Project profitability

Strict anti-surveillance policy